As the global market continues to evolve, investors are perpetually faced with the challenge of timing their entry and exit points. Sector rotation strategies offer a dynamic approach, allowing investors to pivot their portfolio’s focus toward sectors expected to outperform the broader market at certain times.

Exchange-Traded Funds (ETFs) have become the preferred vehicle for executing these strategies due to their diversification benefits, liquidity, and the ease with which they can be bought and sold. This article will look at the concept of sector rotation and elucidate how ETFs can be utilised to operationalise such strategies effectively.

Understanding sector rotation

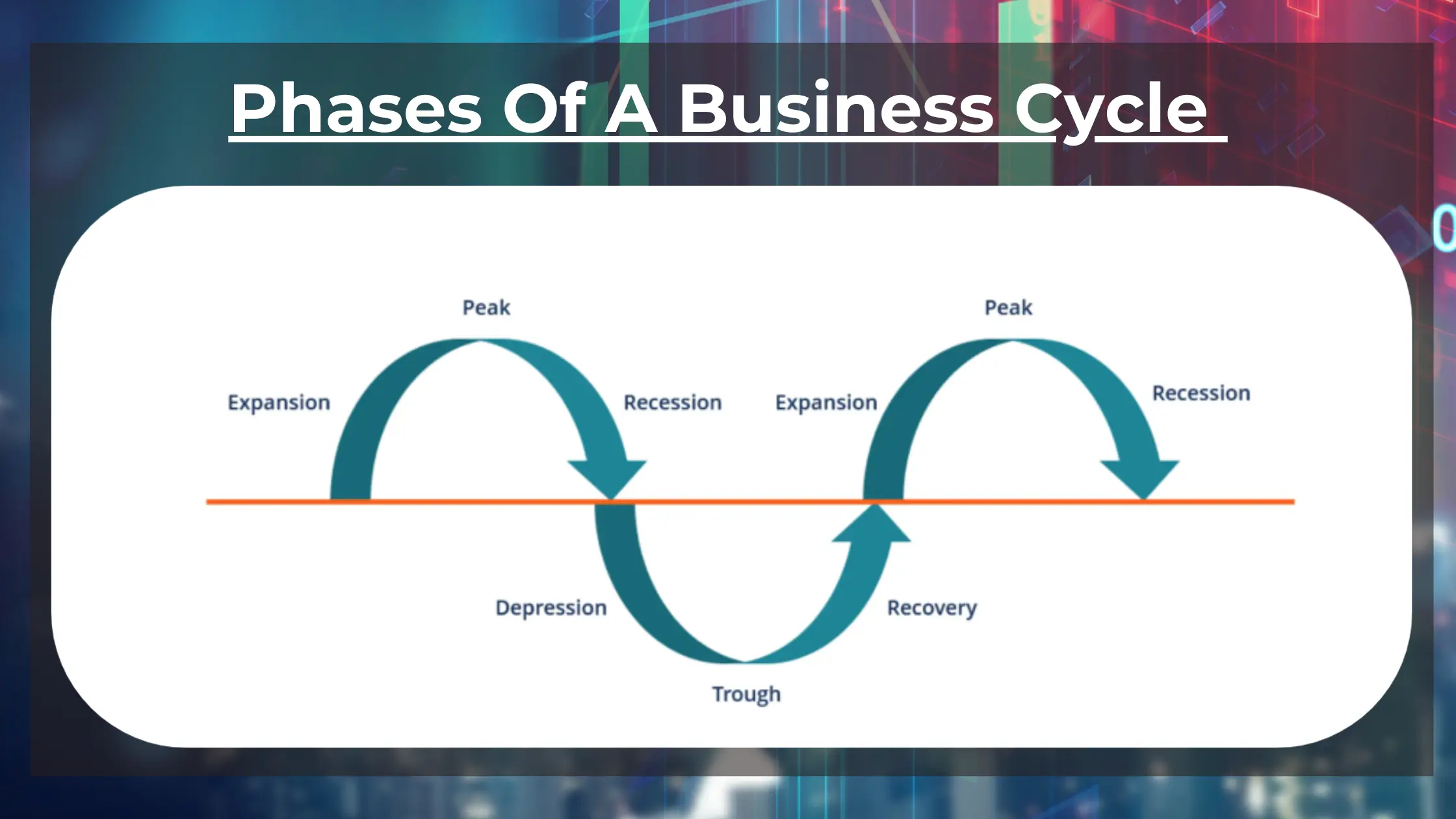

The concept of sector rotation revolves around the cyclical nature of financial markets. Different sectors perform well or poorly at various stages. For example, cyclical sectors like technology and industrials may outperform during economic expansions, while defensive sectors such as consumer staples and utilities may take the lead during downturns.

Sector rotation strategies aim to capitalise on such trends, moving investments from sectors likely to underperform to ones expected to outperform. This active management approach can be guided by economic indicators, earnings reports, or other data signalling a shift in market conditions.

Investors may also employ a systematic approach, such as the ‘seasonal rotation strategy,’ which relies on historical data to predict sector strength or weakness periods. In contrast, others adopt a ‘momentum strategy,’ which picks sectors with short-term solid performance metrics.

ETFs: A tool for sector rotation

One of the key advantages of ETFs is diversification. By holding various stocks within a single sector, ETFs provide instant diversification, reducing the risk associated with a concentrated bet on a single stock. This diversification also helps mitigate sector-specific risks, allowing investors in Singapore to spread their investments across multiple companies within a sector.

Another advantage of ETFs is liquidity. Unlike many mutual funds, ETFs are bought and sold at market-determined prices throughout the trading day. It provides ease of transaction and flexibility, even in volatile markets. Investors can enter or exit positions in ETFs anytime during market hours, enabling them to take advantage of market movements.

Cost-effectiveness is another appealing aspect of ETFs because they could have lower expense ratios than mutual funds, which makes them a much more affordable option for Singaporean investors looking to rotate sectors frequently. Lower expenses can significantly impact long-term returns, allowing investors to maximise their potential.

Transparency is a notable feature of most ETFs. They disclose their portfolio holdings daily, enabling investors to see what assets they own. This level of transparency is unlike mutual funds, which typically disclose their holdings monthly or quarterly. This real-time visibility of ETF holdings empowers investors to make informed decisions based on the fund’s underlying assets.

ETFs provide a compelling investment option for sector rotation strategies. With diversification, liquidity, cost-effectiveness, and transparency, they offer investors a powerful tool to navigate the ever-changing market dynamics.

Types of sector ETFs

There are two main types of sector ETFs: broad-based and narrow-based. Broad-based sector ETFs cover an entire industry group, offering exposure to various sub-sectors and companies. Narrow-based sector ETFs target a specific sub-sector, such as technology hardware or consumer discretionary. Which type an investor chooses depends on their level of conviction and preference for diversification.

Investors should also note that some sector ETFs may use leverage or derivatives to amplify returns or aim to provide the inverse performance of the sector index. These leveraged and inverse ETFs are typically for sophisticated investors due to their increased risk and complexity. Novice investors should use a broker’s services or consult an expert before investing in these ETFs. Saxo Capital Markets PTE provides a comprehensive trading platform with access to multiple ETFs from global markets.

How to implement sector rotation with ETFs

Implementing a sector rotation strategy with ETFs requires careful planning and a well-defined investment thesis. Here are the steps you can take to put this strategy into action:

- Identify macro trends: Regularly review macroeconomic data and market indicators to identify potential shifts affecting sector performance.

- Select ETFs: Choose the ETFs that provide exposure to the sectors you believe will outperform. Look for ETFs with low expense ratios, minimal tracking error, and sufficient average daily volume for liquidity.

- Set allocation targets: Decide how much of your portfolio you want to allocate to each sector. It should be based on your risk tolerance, sector outlook, and investment objectives.

- Monitor and rebalance: Regularly evaluate the performance of your sector ETFs and the market. Rebalance your portfolio by selling sectors that no longer fit your investment thesis and buying into industries that do.

Risks and considerations

While sector rotation strategies can offer the potential for enhanced returns, they do come with several risks and considerations:

- Market timing risk: Failure to correctly time the market could lead to missed opportunities and increased transaction costs. It is a risk that investors take in any active management strategy.

- Sector-specific risks: Each sector carries risks; for example, the technology sector may be subject to rapid innovation and regulatory risks, while the energy sector may be vulnerable to commodity price fluctuations.

- Performance uncertainty: Predicting sector performance is inherently uncertain, and not all rotation decisions will be correct. Diversification does not eliminate the possibility of investment losses.

All in all

Sector rotation strategies allow investors to take advantage of the different phases of the economic cycle and potentially enhance their portfolio’s performance. ETFs can make executing these strategies more accessible by providing a cost-effective, liquid, and diversified means of investing in sectors. Yet, investors must conduct thorough research, remain disciplined, and understand the risks associated with active sector rotation. By diligently following these strategies, investors can seek to capitalise on sector trends and gain a competitive edge in their investment approach.