Investing in mutual funds through a Systematic Investment Plan (SIP) has emerged as one of the most common methods for saving money and gradually growing wealth over time. An essential tool that supports this process is the SIP calculator. Using a SIP calculator helps investors plan their investments and track their progress, hence assisting them in making informed decisions to maximize returns. In this article, we’ll explore how an SIP calculator works, why it’s important, and provide a step-by-step guide on using it effectively.

What is an SIP Calculator?

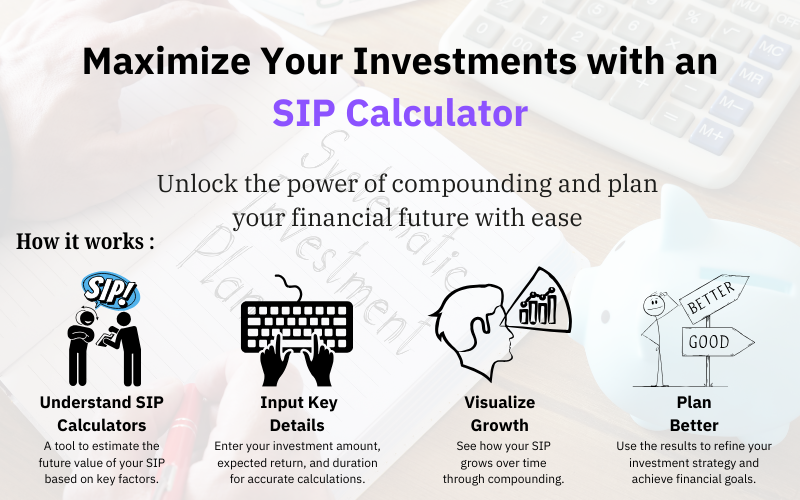

A SIP calculator is an online tool that helps investors calculate the returns they can get on their mutual fund investments through a SIP. All that is required is to input a few simple details, such as the investment amount, the investment period, and the expected rate of return, and the SIP calculator generates a projection of the wealth accumulated over the investment duration. This will help investors set realistic goals and see how their money grows.

SIP is a disciplined investment approach wherein one can invest a fixed amount periodically, say monthly, in a mutual fund. This method ensures that the investor averages out market risks and benefits from the power of compounding and rupee cost averaging. The SIP calculator enhances this experience by providing a clear picture of the future.

Why Use an SIP Calculator?

- Helps in Goal Setting: Before beginning a SIP, it is essential to know what your financial goals are. Be it building a retirement fund, saving for a child’s education, or buying a house, an SIP calculator helps you estimate how much you need to invest every month to achieve these goals.

- Estimates Return: It lets you estimate returns from an SIP on historical average returns. As an outcome, you understand the growth prospects of your investments over the years.

- Visualize Future Wealth: You will find how the growth of your investment could stand over time by using the SIP calculator. This way, you are motivated and kept on track for your financial goals.

- Helps Investment Planning: With the SIP calculator, investment planning becomes easy, as it can provide instant results and avoid long manual calculations. All this is taken into account: monthly contribution, rate of return, and investment duration for an accurate estimation.

- It Adjusts for Market Fluctuations: The SIP calculator works on expected returns but is based on historical data. That way, it is adjusted for market fluctuations, thus giving you a more realistic projection of how your investments might perform over time.

How does an SIP Calculator Work?

It is a rather simple tool to use. It takes just a few basic details and generates accurate results.

Here is how it works:

- Enter the Monthly Investment Amount: This is the amount you will invest in the SIP every month. It can be a few hundred rupees or thousands of rupees, depending on your financial capacity.

- Set the Duration: Now, you need to decide how long you want to invest through the SIP. Generally, the longer the duration, the more time your investment has to grow, and the greater the potential returns. The rate of return which is expected on the SIP would be asked. A general historical tendency for mutual fund return is between 10% to 15%, though it keeps on changing, and it could be higher based on the specific type of mutual fund and even market conditions at different times.

- Calculate the Returns: After filling up all the information, click on the “calculate” button. The SIP calculator will come up with a detailed summary comprising the total amount invested, projected returns, and the corpus at the end of the investment period.

How to Use an SIP Calculator: Step-by-Step Guide

Now that we have covered the basics, let’s proceed to a step-by-step guide on how to use an SIP calculator effectively.

Step 1: Define Your Investment Goals

Before you start using the SIP calculator, you should define your financial goals. Do you want to save for a short-term goal, such as buying a car or going on a vacation, or for long-term goals, like retirement? Defining your goals will help you select the right amount, duration, and risk profile for your investment.

Step 2: Select Your Investment Amount

Once you have determined your goals, the next step is to determine how much money you can invest each month. The SIP calculator will help you see how your selected monthly investment will grow over time. Remember that investing a higher amount will give you greater returns, but you should select an amount that you can afford each month and within your financial capacity.

Step 3: Determine the Investment Period

The length of time you invest in SIP will determine the overall returns. For example, short-term SIPs (1–3 years) are useful for meeting any short-term financial objectives, but long-term SIPs (5 years and more) will allow the compounding power to take hold. You can see the returns vary by changing the period using the SIP calculator.

Step 4: Choose the Expected Rate of Return

The expected rate of return is one of the important ones. Although the SIP calculator does work using historical returns (10-15%), one must be practical and conservative. Here again, the rate of return will depend on the particular mutual fund product you have selected for investment. Equity funds are more prone to provide a higher rate of return, though at the cost of higher risk, whereas debt funds give stable returns with lower risk.

Step 5: Review the Calculations

Review your results carefully as soon as you have entered all the details into the SIP calculator. Look at the final corpus that the calculator estimates you would have by the end of your investment period. This will make you understand how much the amount you are committing to SIP accounts for your purpose.

Step 6: Adjust If Necessary

If the projected returns do not align with your goals, you can adjust the amount you invest every month or the duration of your investment. You can make quick changes in the SIP calculator to see how that affects your final corpus. Flexibility helps fine-tune your investment strategy so that it aligns with your financial objectives.

Advantages of an SIP Calculator

- Accurate Projections: The SIP calculator uses precise formulas to generate estimates based on your input data. This helps you plan your investment strategy more effectively.

- No Need for Complex Formulas: You don’t need to worry about manual calculations or complex investment formulas. The SIP calculator simplifies everything and provides easy-to-understand results.

- Boosts Financial Confidence: Knowing the potential returns helps boost your confidence in your investment decisions. With a clear picture of your future wealth, you’re more likely to stay committed to your SIP plan.

- Flexible Adjustments: You can adjust your inputs and immediately see the effects, providing you with control over your investment planning. Through experimentation with different amounts, durations, and rates of return, you can establish which strategy best suits your needs

Conclusion

A SIP calculator is a powerful tool that allows an investor to plan his investments, track progress, and make data-driven decisions for maximum returns. Using a SIP calculator can provide you with insight into your future wealth accumulation, set achievable financial goals, and keep you on track with your investment plan.

Remember, an SIP calculator works on historical data but one must know the market scenario and make corrections accordingly. Using an SIP is a very efficient way to secure a better future in terms of finance. Use a SIP calculator today and observe how your money grows over the years!